© Copyright 2015 - FX Hometrader - All rights reserved.

| Test Parameters | Back Test 1 | Back Test 2 |

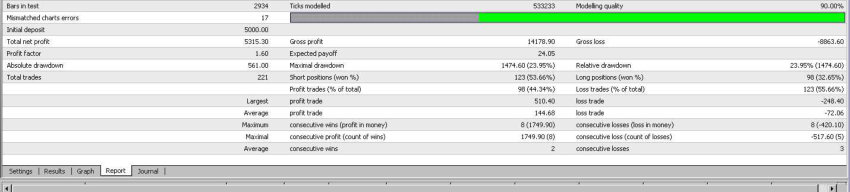

| Capital | $5000 | $5000 |

| Risk Per Trade | 2% | 2% |

| Break Even Point | 0 | 30 |

| Trailing Stop | 0 | 30 |

| Risk Reward Ratio | 2.5x stop and 1.5 X | stop 1X stop on all entries |

| Profit after 1 month | $ 5315.00 | $ 965.00 |

| Absolute Draw Down | $ 561.00 | $ 966.00 |

| % Winning Trades | 44.34% | 63.44% |

| Average Win | $144.68 | $43.58 |

| Average Loss | $72.06 | $63.98 |

| Largest Profit Trade | $510.40 | $120.40 |

Forex Money Management Tutorial

Position sizing is probably the single most important factor affecting the profitability of most Forex traders. Many Forex traders pay mere lip service to the term money management and end up losing their hard earned money. To illustrate the point we have used a back test on our in house automated intra-day 15 min trading system that risks only 2% of capital per trade. The test runs over a 1 month period from 1st May to 31st May 2010, starting with $5000 capital. The profit limit is set to 2.5 times risk on the initial entry and 1.5 times risk on subsequent entries after each trend change. The trades are closed when one of three events occur in the market, profit target is hit, stop loss is triggered or the trend changes. Let’s assume that two traders each learn and traded an identical trading strategy but used different money management principals. The above illustration will clearly show that the trader using the sound money management principals fared far better than the trader who did not. When we compare the results of the two back tests above we can see that the first test with the sound money management principals way outperformed the second back test where we limited the profit potential by adding a trailing stop, a break- even point and reduced the risk reward ratio to 1:1. In spite of test 2 having a far higher win to loss ratio at 63.44% wins compared to only a 44% winning trade ratio on test 1, we can gather from this that the better the risk to reward ratio the less of times we have to win in order to be profitable. A good equity management should consist of the following elements. • First calculate the risk on each trade, limit your risk to 1 or 2 % of your total capital. • Calculate your risk to reward ratio per trade, which should be a minimum of 1.5 times your risk but preferably 2 times risk or higher. • Calculate your position or lot size according to the percentage you are prepared to risk o each trade. • Ensure you adjust your lot size for each trade before you enter the trade. • Never move your stop loss and increase the risk once you are in a trade, there will always be another trade. • If all the criteria don’t fit then rather skip the trade and wait for one that meets all your money management rules. • Ensure you have adequate capital, don’t put yourself under pressure by risking more than you should in order to meet your commitments. • Set up a spreadsheet that will quickly calculate your position size when you enter a trade. Summary 1. By practicing good money management principles you do not have to win as often, simply because each win will be two to three times more than each loss. 2. By risking only a small amount of capital on each trade there should never be any stress in your trading as the loss would be a very small compared to your overall capital. 3. This then begs the question where do you place your stop loss in order to calculate your position size. To learn more see our next tutorial: Where to place my Stop Loss.

- Forex Trading Chart Patterns

- Price Actions Charts

- Fibonacci Trading

- Fibonacchi Levels Tutorials

- Trading with the Elliott Wave

- Trading with Bollinger Bands

- Trading with the MACD

- Candlestick Trading Tutorial

- Pivot Points Trading

- Trading with the RSI Indicator

- Trading with the Stochastic Indicator

- Swing Trading Strategy

- Support and Resistance Levels

- Stop Loss Tutorial

© Copyright 2016 - FX Hometrader - All rights reserved.

Forex Money

Management Tutorial

Position sizing is probably the single most important factor affecting the profitability of most Forex traders. Many Forex traders pay mere lip service to the term money management and end up losing their hard earned money. To illustrate the point we have used a back test on our in house automated intra-day 15 min trading system that risks only 2% of capital per trade. The test runs over a 1 month period from 1st May to 31st May 2010, starting with $5000 capital. The profit limit is set to 2.5 times risk on the initial entry and 1.5 times risk on subsequent entries after each trend change. The trades are closed when one of three events occur in the market, profit target is hit, stop loss is triggered or the trend changes. Let’s assume that two traders each learn and traded an identical trading strategy but used different money management principals. The above illustration will clearly show that the trader using the sound money management principals fared far better than the trader who did not. When we compare the results of the two back tests above we can see that the first test with the sound money management principals way outperformed the second back test where we limited the profit potential by adding a trailing stop, a break- even point and reduced the risk reward ratio to 1:1. In spite of test 2 having a far higher win to loss ratio at 63.44% wins compared to only a 44% winning trade ratio on test 1, we can gather from this that the better the risk to reward ratio the less of times we have to win in order to be profitable. A good equity management should consist of the following elements. • First calculate the risk on each trade, limit your risk to 1 or 2 % of your total capital. • Calculate your risk to reward ratio per trade, which should be a minimum of 1.5 times your risk but preferably 2 times risk or higher. • Calculate your position or lot size according to the percentage you are prepared to risk o each trade. • Ensure you adjust your lot size for each trade before you enter the trade. • Never move your stop loss and increase the risk once you are in a trade, there will always be another trade. • If all the criteria don’t fit then rather skip the trade and wait for one that meets all your money management rules. • Ensure you have adequate capital, don’t put yourself under pressure by risking more than you should in order to meet your commitments. • Set up a spreadsheet that will quickly calculate your position size when you enter a trade. Summary By practicing good money management principles you do not have to win as often, simply because each win will be two to three times more than each loss. By risking only a small amount of capital on each trade there should never be any stress in your trading as the loss would be a very small compared to your overall capital. This then begs the question where do you place your stop loss in order to calculate your position size. To learn more see our next tutorial: Where to place my Stop Loss.| Test Parameters | Back Test 1 | Back Test 2 |

| Capital | $5000 | $5000 |

| Risk Per Trade | 2% | 2% |

| Break Even Point | 0 | 30 |

| Trailing Stop | 0 | 30 |

| Risk Reward Ratio | 2.5x stop and 1.5 X | stop 1X stop on all entries |

| Profit after 1 month | $ 5315.00 | $ 965.00 |

| Absolute Draw Down | $ 561.00 | $ 966.00 |

| % Winning Trades | 44.34% | 63.44% |

| Average Win | $144.68 | $43.58 |

| Average Loss | $72.06 | $63.98 |

| Largest Profit Trade | $510.40 | $120.40 |

- Home

- Introduction to Forex Trading

- Trading Requirements

- Forex Trading Times

- How to Choose Your Broker

- Brokerage Firms

- About Managed Accounts

- Technical Analysis Tutorials

- Forex Trading Tutorials

- Price Action Charts

- Fibonacci Trading

- Fibonacci Levels Tutorial

- Trading with the Elliott Wave

- Trading with Bollinger Bands

- Trading with MACD

- Candlestick Trading Tutorial

- Pivot Points Trading Tutorial

- Pivot Point Calculator

- Trading with the RSI Indicator

- Trading with the Stochastic Indicator

- Swing Trading Strategy

- Stop-Loss Tutorial

- Free Trading Magazines

- Free Trading Software

- Forex Trading Books

- Forex Trading Articles

- Glossary

- About Us

- Contact Us