© Copyright 2015 - FX Hometrader - All rights reserved.

Stop Loss Tutorial

Where to Place Your Stop Loss in a Trade

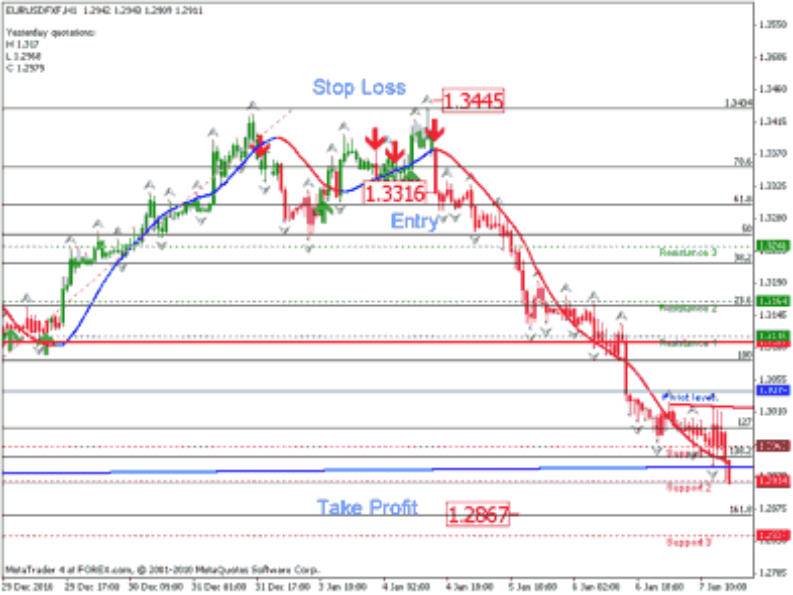

Ask a room full of individual Forex traders where they placed their stop losses on a particular trade and the answers will range from “I don’t use a stop loss”, to “an arbitrary number” used on every trade, or “above or below the previous support or resistance”, maybe a “mental stop loss” or even a “hedge trade in the opposite direction”. Some traders will put forward the argument that stop loss orders are a waste of time as they are continually stopped out only to watch with frustration as the market then continues in the direction they were trading prior to being stopped out, or their brokers use dirty tactics like stop hunting in order to rob them of their hard earned money. It is human nature to dislike losing and once the stop loss has been triggered that money is gone forever. Equally true is the fact that the perfect trading system does not exist and even the biggest and best traders have losses from time to time. If we can accept the fact that we cannot win every trade and that losses are a byproduct of the industry we are in, then how we handle those losses will probably be the determining factor in whether we make money trading or lose our money. Everyone seems to have their own view on where to place a stop loss. In order to answer the above question we need to examine the purpose for having a stop loss in the first place. Stop loss orders in Forex trading should first and foremost be used to protect your capital and ought to be the deciding factor in determining the position size on each trade. Thereafter they should be used to protect our profits once the trade is in the money. It should not simply be as much of a loss as we can stomach on a single trade as this will surly lead to financial ruin. Hopefully this stop loss strategy will help to remove some of the frustration of continually being stopped out of trades. This system works on a combination of chart and equity to help us determine not only where to place our stops but also the position size of the trade. Equity First we are going to determine how much of our capital we are prepared to risk on a single trade and to do this we will work on a percentage of our capital rather than an arbitrary figure. If we refer back to the previous article on money management and only risk 2% of our capital on a trade and assume we have $10,000 in our account then we will only risk $200 on the trade. Charts Next we refer to our stop loss tutorial chart above in order to determine where to place the stop loss. For this exercise we are going to use Metatrader charts on a 1 hour time frame, looking at current market conditions. The red arrow represents a trend change as do the red candles to the downside, the red long term filter line also represents the trend change from blue (up) to red (Down)for the 1hr time frame. The swing high on the up move is at 1.3434 so we are going to place our stop loss 10 pips above the swing high at 1.3444. We enter the market at 1.3316 when our sell signal is triggered by all the indicators. Our Stop Loss is therefore (1.3444 - 1.3316 = 128) Pips. Our risk for the trade is $200/128=1.56 lots for this trade. Before we enter the trade we need to determine our risk to reward ratio to ensure that we do not risk more than we can potentially make on the trade and for this I have used the Fibonacci tool and determined the market can potentially drop all the way to the 1.618 extention at 1.2867 (1.3316 – 1.2867 = 449) pips a factor of 3.51 x risk. Should we achieve our target we will realize a profit of $700.44 for a risk of only $200. With the current price near the 1.2900 mark it only about 40 pips from the target we can move our stop to the last high and wait till the target is hit. By using this method we never risk more than we can afford and we can also trade larger time frames with bigger stops by simply reducing our lot size without taking a larger risk. Summary • Always use a stop loss. • Use the last swing high or low to place your Stop loss • Calculate your risk percentage. • Calculate the Risk Reward ratio to determine if the trade is worth doing. • Calculate your position size based on the equity chart method. • Never move your stop loss to increase your risk. • Once in profit use your stop loss to lock in your profits.

- Forex Trading Chart Patterns

- Price Actions Charts

- Fibonacci Trading

- Fibonacchi Levels Tutorials

- Trading with the Elliott Wave

- Trading with Bollinger Bands

- Trading with the MACD

- Candlestick Trading Tutorial

- Pivot Points Trading

- Trading with the RSI Indicator

- Trading with the Stochastic Indicator

- Swing Trading Strategy

- Support and Resistance Levels

- Stop Loss Tutorial

© Copyright 2016 - FX Hometrader - All rights reserved.

Stop Loss Tutorial

Where to Place Your Stop Loss

in a Trade

Ask a room full of individual Forex traders where they placed their stop losses on a particular trade and the answers will range from “I don’t use a stop loss”, to “an arbitrary number” used on every trade, or “above or below the previous support or resistance”, maybe a “mental stop loss” or even a “hedge trade in the opposite direction”. Some traders will put forward the argument that stop loss orders are a waste of time as they are continually stopped out only to watch with frustration as the market then continues in the direction they were trading prior to being stopped out, or their brokers use dirty tactics like stop hunting in order to rob them of their hard earned money. It is human nature to dislike losing and once the stop loss has been triggered that money is gone forever. Equally true is the fact that the perfect trading system does not exist and even the biggest and best traders have losses from time to time. If we can accept the fact that we cannot win every trade and that losses are a byproduct of the industry we are in, then how we handle those losses will probably be the determining factor in whether we make money trading or lose our money. Everyone seems to have their own view on where to place a stop loss. In order to answer the above question we need to examine the purpose for having a stop loss in the first place. Stop loss orders in Forex trading should first and foremost be used to protect your capital and ought to be the deciding factor in determining the position size on each trade. Thereafter they should be used to protect our profits once the trade is in the money. It should not simply be as much of a loss as we can stomach on a single trade as this will surly lead to financial ruin. Hopefully this stop loss strategy will help to remove some of the frustration of continually being stopped out of trades. This system works on a combination of chart and equity to help us determine not only where to place our stops but also the position size of the trade. Equity First we are going to determine how much of our capital we are prepared to risk on a single trade and to do this we will work on a percentage of our capital rather than an arbitrary figure. If we refer back to the previous article on money management and only risk 2% of our capital on a trade and assume we have $10,000 in our account then we will only risk $200 on the trade. Charts Next we refer to our stop loss tutorial chart above in order to determine where to place the stop loss. For this exercise we are going to use Metatrader charts on a 1 hour time frame, looking at current market conditions. The red arrow represents a trend change as do the red candles to the downside, the red long term filter line also represents the trend change from blue (up) to red (Down)for the 1hr time frame. The swing high on the up move is at 1.3434 so we are going to place our stop loss 10 pips above the swing high at 1.3444. We enter the market at 1.3316 when our sell signal is triggered by all the indicators. Our Stop Loss is therefore (1.3444 - 1.3316 = 128) Pips. Our risk for the trade is $200/128=1.56 lots for this trade. Before we enter the trade we need to determine our risk to reward ratio to ensure that we do not risk more than we can potentially make on the trade and for this I have used the Fibonacci tool and determined the market can potentially drop all the way to the 1.618 extention at 1.2867 (1.3316 – 1.2867 = 449) pips a factor of 3.51 x risk. Should we achieve our target we will realize a profit of $700.44 for a risk of only $200. With the current price near the 1.2900 mark it only about 40 pips from the target we can move our stop to the last high and wait till the target is hit. By using this method we never risk more than we can afford and we can also trade larger time frames with bigger stops by simply reducing our lot size without taking a larger risk.

- Home

- Introduction to Forex Trading

- Trading Requirements

- Forex Trading Times

- How to Choose Your Broker

- Brokerage Firms

- About Managed Accounts

- Technical Analysis Tutorials

- Forex Trading Tutorials

- Price Action Charts

- Fibonacci Trading

- Fibonacci Levels Tutorial

- Trading with the Elliott Wave

- Trading with Bollinger Bands

- Trading with MACD

- Candlestick Trading Tutorial

- Pivot Points Trading Tutorial

- Pivot Point Calculator

- Trading with the RSI Indicator

- Trading with the Stochastic Indicator

- Swing Trading Strategy

- Stop-Loss Tutorial

- Free Trading Magazines

- Free Trading Software

- Forex Trading Books

- Forex Trading Articles

- Glossary

- About Us

- Contact Us