© Copyright 2015 - FX Hometrader - All rights reserved.

Why You Should Have a Forex Trading Journal

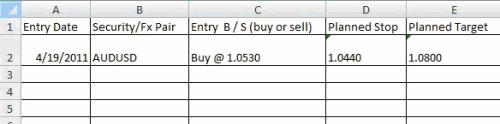

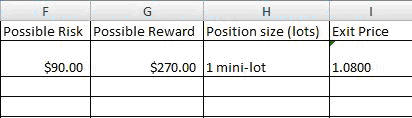

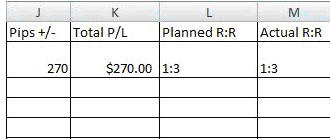

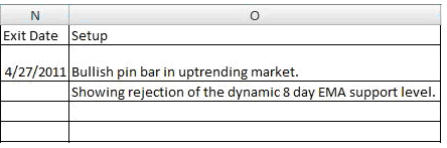

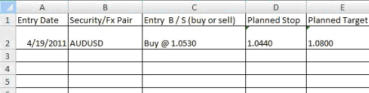

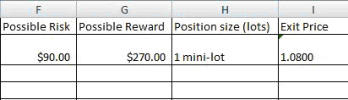

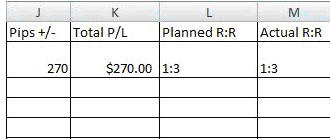

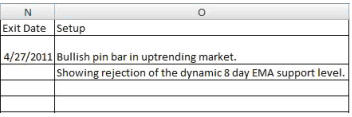

To start with you will need a Forex trading journal (also called a Traders log) because you need to track your trading results over time. The reason being, that you can page back after a few months of trading, and scrutinize your trading performance trade after trade. It will also become clear to you why you made certain profitable trades and some losing trades. Many beginner traders get caught up in the results of every individual trade, whilst seasoned traders know that they can only measure their trading performance over a period of time. Having this type of journal as a reminder is very important, especially when you start out with your trading career. It helps keeping you focused and it helps to remove any emotion you might attach to any one trade. How do I create my Trading Journal and what must be included? Follow the screen shots below on how a trading journal can look like. We have entered example trade parameters below each heading just for demonstration purposes; you can customize it to fit the exact requirements you would need. • Entry date: This will be the date you entered the trade, the date you got filled is what you want here (if the order got filled). If the order never gets filled just delete it from you journal. • Security / FX pair: The particular security traded, this will either be the currency pair you are trading. • Entry B / S: Here you enter whether you bought or sold (Depending if you went short or long) and then record the specific level or price you entered at. • Planned Stop and Planned Target: You will put your pre-determined stop and target price in these boxes. It's very important to pre-define your stop level and target level. • Possible $ Risk: How much money are you prepared to lose on the trade? • Possible $ Reward: How much money are you aiming to make on the trade? • Position size (lots): Your position size on the trade, or the number of micro / mini / standard lots presently being traded. • Exit Price: What price did you actually exit the trade at? • Pips +/-: How many pips you gained or lost on the trade. • Total P/L: How much total money you made or lost on the trade. • Planned R: R: What was the pre-defined risk reward ratio of the trade? • Actual R: R: What did the risk reward ratio eventually end up being? This is important, if you aren't achieving a risk reward of 1:2 or greater on your winning trades, you will see that over time it's very hard to be profitable in the Forex markets. You will also notice that if you take profits too early this will greatly lower your risk: reward ratio and visa versa if you take a risk that is larger than what you had planned the same thing happens. • Exit date: The date you closed the trade. • Setup: What was your setup / why did you enter the trade? Did you trade a valid price action trading strategy? Summary Logging your trading results is an essential part to becoming a successful and seasoned Forex trader. As your trading journal entries progresses trade after trade, you will start to see the significance of it in more perspective. The power of risk reward and money management will become very clear to you as you look back over your past trades after a few months went of logging your trades.

- Forex Trading Chart Patterns

- Price Actions Charts

- Fibonacci Trading

- Fibonacchi Levels Tutorials

- Trading with the Elliott Wave

- Trading with Bollinger Bands

- Trading with the MACD

- Candlestick Trading Tutorial

- Pivot Points Trading

- Trading with the RSI Indicator

- Trading with the Stochastic Indicator

- Swing Trading Strategy

- Support and Resistance Levels

- Stop Loss Tutorial

© Copyright 2016 - FX Hometrader - All rights reserved.

Why You Should Have a

Forex Trading Journal

To start with you will need a Forex trading journal (also called a Traders log) because you need to track your trading results over time. The reason being, that you can page back after a few months of trading, and scrutinize your trading performance trade after trade. It will also become clear to you why you made certain profitable trades and some losing trades. Many beginner traders get caught up in the results of every individual trade, whilst seasoned traders know that they can only measure their trading performance over a period of time. Having this type of journal as a reminder is very important, especially when you start out with your trading career. It helps keeping you focused and it helps to remove any emotion you might attach to any one trade. How do I create my Trading Journal and what must be included? Follow the screen shots below on how a trading journal can look like. We have entered example trade parameters below each heading just for demonstration purposes; you can customize it to fit the exact requirements you would need. • Entry date: This will be the date you entered the trade, the date you got filled is what you want here (if the order got filled). If the order never gets filled just delete it from you journal. • Security / FX pair: The particular security traded, this will either be the currency pair you are trading. • Entry B / S: Here you enter whether you bought or sold (Depending if you went short or long) and then record the specific level or price you entered at. • Planned Stop and Planned Target: You will put your pre-determined stop and target price in these boxes. It's very important to pre-define your stop level and target level. • Possible $ Risk: How much money are you prepared to lose on the trade? • Possible $ Reward: How much money are you aiming to make on the trade? • Position size (lots): Your position size on the trade, or the number of micro / mini / standard lots presently being traded. • Exit Price: What price did you actually exit the trade at? • Pips +/-: How many pips you gained or lost on the trade. • Total P/L: How much total money you made or lost on the trade. • Planned R: R: What was the pre- defined risk reward ratio of the trade? • Actual R: R: What did the risk reward ratio eventually end up being? This is important, if you aren't achieving a risk reward of 1:2 or greater on your winning trades, you will see that over time it's very hard to be profitable in the Forex markets. You will also notice that if you take profits too early this will greatly lower your risk: reward ratio and visa versa if you take a risk that is larger than what you had planned the same thing happens. • Exit date: The date you closed the trade. • Setup: What was your setup / why did you enter the trade? Did you trade a valid price action trading strategy? Summary Logging your trading results is an essential part to becoming a successful and seasoned Forex trader. As your trading journal entries progresses trade after trade, you will start to see the significance of it in more perspective. The power of risk reward and money management will become very clear to you as you look back over your past trades after a few months went of logging your trades.

- Home

- Introduction to Forex Trading

- Trading Requirements

- Forex Trading Times

- How to Choose Your Broker

- Brokerage Firms

- About Managed Accounts

- Technical Analysis Tutorials

- Forex Trading Tutorials

- Price Action Charts

- Fibonacci Trading

- Fibonacci Levels Tutorial

- Trading with the Elliott Wave

- Trading with Bollinger Bands

- Trading with MACD

- Candlestick Trading Tutorial

- Pivot Points Trading Tutorial

- Pivot Point Calculator

- Trading with the RSI Indicator

- Trading with the Stochastic Indicator

- Swing Trading Strategy

- Stop-Loss Tutorial

- Free Trading Magazines

- Free Trading Software

- Forex Trading Books

- Forex Trading Articles

- Glossary

- About Us

- Contact Us